[ad_1]

Growing protectionism and modernized trade enforcement are significantly affecting importers and exporters. Increased protectionism is leading to increases in landed costs for imported products. Better systems at customs agencies can lead to increases in cycle times for companies that are not on top of the complex documentation requirements associated with trade.

And yet Jerry Peck, the vice president of product strategy for global trade and transportation execution at QAD, made the point that when global companies think about digital supply chains, global trade compliance is often not part of their thinking. QAD, inc. provides enterprise resource planning and other business applications for manufacturers.

While the topic of trade compliance can cause supply chain executive’s eyes to glaze over, if a company truly wants a digital supply chain, trade compliance really needs to be part of their strategy. In short, customs compliance must become proactive and strategic rather than just focused on having the proper documentation and accurately paying duties.

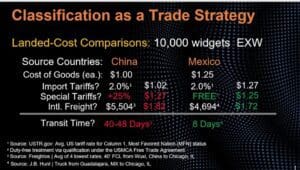

For example, it can look like imports from China are cheaper than the same goods imported from Mexico if a company is not relying on analysis produced by an advanced good global trade compliance (GTC) system. Goods that look like they are 25% cheaper, may be 6% more expensive once special tariffs and international freight costs are factored in. Furthermore, the transit time from Mexico averages just 8 days versus 40 to 48 days from China. Longer lead times also impose costs in the form of higher just-in-case inventory buffers.

Global trade compliance really needs to be part of companies strategic sourcing programs. At its heart a GTC is not just a governance tool, it is a critical tool for risk management. In addition to using a GTC as part of a landed cost analysis, GTC solutions help companies adhere to restricted party lists. Restricted party lists tell companies who they can and can’t legally do business with.

In addition to the restricted party lists, there are also watch lists that companies should subscribe to. Watch lists help determine whether a company should want to do business with another company or entity based on that company’s financial strength, whether they have been involved in criminal activities or unethical actions, and other sourcing goals.

Adhering to trade law can be difficult. For foreign companies who do business in the US, it is not just a matter of making sure they don’t import goods from sanctioned entities into the US, these foreign companies can’t import goods from sanctioned companies to any nation in the world they operate in if they want to continue to do business in the U.S. Other nations also have restricted party lists. However, many nations defer to the US list when creating their own sanctioned party list.

The regulations surrounding who a company can or cannot do business with are not straight forward. For example, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) 50 Percent Rule imposes sanctions on companies with combined ownership by (“blocked”) parties of 50 percent or more. OFAC recommends “caution” in dealing with companies in which one or more sanctioned entities hold large stakes that are less than 50 percent. So a “bad actor” might own 49% of a company that is exporting goods. While that company is not on a restricted party list, the products from that company would be much more likely to be held up at customs and subject to additional inspections. Other types of products can also be subject to increased scrutiny.

QAD has created import “admissibility flags” that fire up in the import system and let a customer know that a particular imported product is one that customs has targeted for review. “You may want to start,” Mr. Peck explained, “by ensuring that you’ve got all of your documentation lined up in support of that review process should you get singled out.”

These admissibility fields also light up if a product needs special documentation from the Federal Drug Administration, Department of Transportation, or other agencies. Goods might fly through customs, but if not all the import conditions from other government agencies have been satisfied, the goods may just sit in a port warehouse accumulating demurrage charges, delaying a production run, or angering customers who don’t receive their goods when promised.

Creating a foreign trade zone (FTZ) strategy is another way that a trade compliance department can add strategic value to their company. “You’re filing an FTZ entry, not a customs entry, so a company is not paying any duties at that point,” Mr. Peck said. “The company can do anything they want to with the good, so it’s much more liberal than a customs bonded warehouse.” The company can do manufacturing in the FTZ, “which is why the automobile manufacturers all use foreign trade zones. They can bring in all the collective parts, manufacture a car and pay an ‘inverted tariff.’” With an inverted tariff, instead of paying duty on all the individual components, the company pays the duty on the finished product. For many products, this leads to significantly lower tariffs.

But it is also possible to export from an FTZ in one nation to other countries. The advantage to a global supply chain can be lower landed costs. As we saw in the example at the beginning of the article, importing from China can be more expensive than exporting from Mexico because of special taxes that apply to China but not Mexico. An inverted tax strategy can magnify the landed cost differential.

FTZ’s have many advantages. There can be lower administrative costs because a company is allowed to make weekly declarations versus a declaration as the shipment comes in. A company is also avoiding any state or local inventory taxes and achieving lower broker fees. But more important than duty deferral is duty optimization through an intelligently constructed global supply chain.

[ad_2]

Source link